Valuation Using Multiples Valuation - Definition and Examples

Various methods can be used to measure the value of a business. One popular approach is valuation using multiples valuation

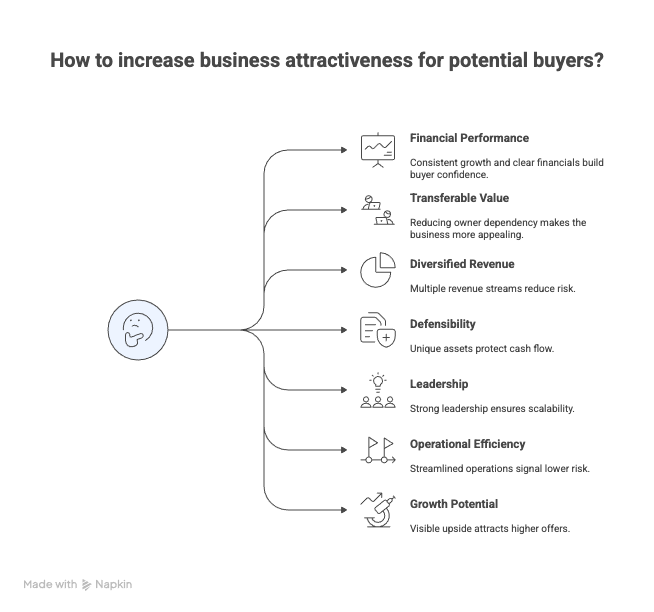

Discover the 7 factors that make your business more attractive to buyers — and how improving your business attractiveness can increase your enterprise value and close your value gap faster.

Discover the 7 factors that make your business more attractive to potential buyers — and how improving your business attractiveness can increase your enterprise value and close your value gap faster.

When it comes to selling your business, price isn’t everything — but attractiveness is. Buyers pay premiums for businesses that are stable, transferable, and capable of thriving without the owner. Whether you’re planning a sale next year or in ten, knowing what makes a business desirable gives you control over your valuation long before due diligence begins.

In this guide, we’ll break down the 7 key factors that increase your business’s attractiveness — and how to strengthen them to command top dollar.

Buyers want confidence in what they’re buying. Consistent revenue growth, healthy profit margins, and accurate documentation all send a clear signal: this business is stable and scalable.

Pro tip: Benchmark your financial health annually to identify trends before buyers do. Maus’s Business Readiness Planning Kit helps business owners evaluate both operational and financial readiness across value drivers.

Key metrics buyers review:

If your business depends on you, it’s worth less. Buyers are wary of companies where the owner is the rainmaker, operations manager, and chief problem-solver rolled into one.

A transferable business is systemized, documented, and runs smoothly without daily owner input.

Ask yourself:

Reducing owner dependency directly increases transferable value — one of the main components of enterprise value.

Learn more in What Is Transferable Value?

A business built on a single major client or one sales channel is inherently risky. Buyers value diversity — in customers, suppliers, and revenue streams.

Ways to strengthen this factor:

Diversification reduces your value gap — the space between what your business is worth today and what it could be worth at exit.

Explore more with Value Gap.

An attractive business has something competitors can’t easily copy — whether that’s intellectual property, strong brand reputation, or unique processes.

Examples:

Buyers want confidence that cash flow can be protected. Document what makes your company hard to replicate — and back it up with systems, contracts, and consistent results.

Strong businesses don’t crumble when leadership changes. A solid management team signals to buyers that the company can scale and sustain success.

Succession readiness is part of broader exit planning — the process of preparing your company, your finances, and yourself for transition.

Learn how in Exit Strategies for Entrepreneurs.

Clean operations = higher valuation. Buyers look for businesses that are streamlined, data-driven, and easy to manage post-sale.

Efficiency signals lower risk. It also makes transitions smoother — which can be the difference between a fair offer and a premium.

Tighten up:

See examples in What Are the Benefits of Strategic Planning for Entrepreneurs.

Even a well-run company won’t attract top offers without visible upside. Buyers pay for potential — and they’ll project it from your growth strategy.

You can show growth potential by:

Growth doesn’t have to be speculative — it just has to be plausible and proven. The more you can demonstrate scalability, the higher the multiple you’ll command.

Improving your business’s attractiveness isn’t just about preparing for sale — it’s about building a stronger, more independent company today. The same factors that impress buyers also create freedom, profitability, and resilience for you as an owner.

If you’re ready to measure where your business stands, start with a Maus Business Readiness Assessment or connect with a Certified Exit Planning Advisor (CEPA) to develop your value acceleration roadmap.

Various methods can be used to measure the value of a business. One popular approach is valuation using multiples valuation

Learn the maturity value definition, meaning, and calculation. Discover how value at maturity connects to exit planning and business valuation.

This article defines value drivers in business, their role in value-driven enterprise risk management, and how companies can identify...

Be the first to know about new tools and knowledge from the fast-paced world of exit planning.