What is exit planning? It’s a question that many business owners may ask themselves when they start thinking about the future of their company. Essentially, exit planning is the process of creating a strategic plan for leaving a business.

This plan outlines the steps and considerations involved in transferring ownership or control of the company, whether through a sale, succession, or other means. In short, an exit plan is a roadmap for the eventual departure of the business owner from the company.

Divestopedia very simply puts it, Exit planning is the complete strategy for exiting a privately held company.

In this blog post, we’ll delve deeper into what exit planning is and why all business owners need to have an exit plan in place.

Understanding What is Exit Planning?

It is a critical aspect of business ownership that every small business owner should be familiar with. In simple terms, business exit planning is the strategic process of creating a plan for leaving a company.

It involves thinking ahead and considering various scenarios, such as business valuation for selling the business or passing it on to a successor. The purpose of a business exit plan is to ensure a smooth transition and maximize the value of the business when the time comes to exit.

This process requires careful consideration of various factors, including financial planning, tax implications, and legal considerations. It is not a one-size-fits-all approach, as every business is unique and may require a different exit strategy. However, the ultimate goal is to secure the owner’s financial future and create a sustainable business legacy.

By understanding the importance of business exit planning, small business owners can effectively plan for their future and ensure the long-term success of their company.

Why Is Exit Planning Crucial for Your Business?

Exit planning is crucial for your business for several reasons. First, it provides a clear business plan or roadmap for the future. Without a plan in place, the transition of ownership or control can become chaotic and uncertain. By creating an exit plan, you can ensure that your business continues to thrive even after you’re no longer at the helm.

It maximizes the value of your privately owned business. When it’s time to sell or pass on your company, having a well-thought-out plan can increase its attractiveness to potential buyers or successors. It allows you to identify and address any weaknesses or challenges that may impact the value of your business and take steps to overcome them.

It protects your financial future. By carefully considering factors such as taxes, financial planning, and legal considerations, you can position yourself to exit your business with minimal financial burden. This ensures that you can enjoy the fruits of your labor and maintain a comfortable lifestyle after leaving your company.

Overall, developing an exit strategy is crucial for the long-term success and sustainability of your business. It allows you to control your legacy, protect your financial interests, and provide a smooth transition for the future. Don’t overlook the importance of having an exit plan in place – start planning today for a prosperous tomorrow.

Key Question About Your Exit Objectives

- How much is your business worth now?

- Is this enough to retire or move on?

- How much would you like to sell the business for?

- How much would you need after tax to fund your lifestyle?

- When would you like to sell?

- Who do you want to sell or transfer your business to?

Every Business Owner Needs an Exit Planning Process

It’s important to understand that exit planning is not just about the baby boomers. It is not solely about the value of the business either. As baby boomers near retirement and the average age of small business owners increases, the age-old laws of supply and demand come into play. The higher the supply, the more likely a downward pressure on price will be applied. It is a myth to think this is an age and retirement issue. On the contrary, these forces affect the value of all business owners, regardless of age.

A major impediment to succession planning is that most entrepreneurs don’t understand it. They don’t appreciate the drivers underpinning the creation of an exit strategy. Nor do they associate personal wealth with wellness. An exit strategy needs to be achievable with a realistic time frame and measurable milestones. It also needs to link with a business owner’s wealth, risk, and tax plan and relates directly to personal wellness and the ‘life after’ plan.

Industries That Benefit From Exit Planning

Exit planning is a crucial process for businesses across various industries. While every business can benefit from having an exit plan, there are certain industries where exit planning is especially essential.

One industry that greatly benefits from exit planning is the manufacturing industry. Manufacturing businesses often have complex operations, extensive assets, and specialized equipment. Planning for the eventual exit ensures a smooth transition of ownership and prevents disruptions in production. It also allows business owners to maximize the value of their manufacturing business by addressing any operational or financial issues before selling.

Another industry that benefits from an exit plan is professional services, such as accounting or legal firms. These businesses heavily rely on the expertise and reputation of their owners. Creating an exit plan ensures a seamless transfer of clients and guarantees that the business will continue to thrive under new leadership.

Additionally, industries that require significant capital investments, such as healthcare or technology, can greatly benefit from exit planning. These industries often have high valuations and complex regulatory considerations. Planning allows owners to strategically position their businesses for a successful exit and secure their financial future.

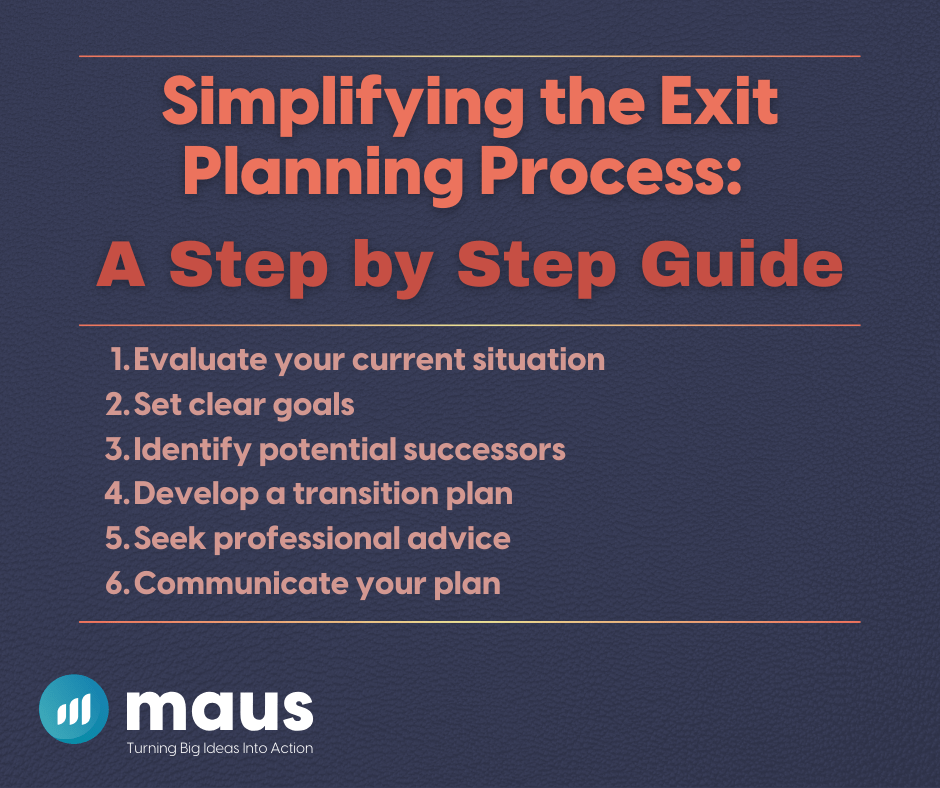

Simplifying the Exit Planning Process: A Step by Step Guide

When it comes to exit planning, breaking down the process into 6 actionable steps can make it feel much more manageable.

Here is a step-by-step guide to simplify the exit planning process:

1. Evaluate your current situation:

Start by assessing the current state of your business, including its financial health, market position, and operational efficiency. Identify any areas that may need improvement or attention before you can successfully exit.

2. Set clear goals:

Determine your desired outcome from the exit. Are you looking to sell the business to a third party or pass it on to a family member? Clarify your objectives and timeline to guide your decision-making process.

3. Identify potential successors:

If you plan to pass on the business, consider who might be the most suitable candidate to take over. Whether it’s a family member or a key employee, assess their qualifications, commitment, and willingness to step into a leadership role.

4. Develop a transition plan:

Create a detailed plan outlining the steps necessary for a smooth transition of ownership or control. This plan should include specific timelines, responsibilities, and contingencies to address any potential challenges that may arise.

5. Seek professional advice:

Engage with experienced professionals, such as lawyers, accountants, and business advisors, who specialize in exit planning. They can provide valuable guidance on tax implications, legal considerations, and financial planning to ensure a successful exit.

6. Communicate your plan:

Once your exit plan is in place, it’s crucial to communicate your intentions to key stakeholders, such as employees, customers, and suppliers. Open and transparent communication can help ease concerns and maintain confidence in the future of the business.

Remember, the exit planning process may vary depending on the unique characteristics of your business. It’s essential to tailor the steps outlined here to suit your specific circumstances. With a step-by-step plan in place, you’ll be better prepared to navigate the exit process and secure the future success of your business.

Exit Planning Resource: Exit Planning Institute

If you’re a small business owner looking for resources to help you with your exit planning journey, the Exit Planning Institute is a valuable resource to consider. The Exit Planning Institute (EPI) is a professional organization dedicated to providing education, resources, and support for business owners and their advisors in the field of exit planning.

EPI offers a variety of tools, training programs, and networking opportunities to help business owners navigate the complex world of exit planning. Whether you’re just starting to explore exit planning or you’re creating your exit plan, the EPI can provide the knowledge and expertise you need to make informed decisions and create a successful exit strategy.

From educational webinars to certification programs, the Exit Planning Institute is a go-to resource for business owners who want to ensure a smooth and prosperous transition out of their businesses.

Best Software for Exit Planning

When it comes to exit planning, having the right exit planning software can greatly streamline the process and ensure a successful outcome. There are several software options available that are specifically designed to assist business owners in creating and executing their exit plans.

One popular option is Maus Exit & Succession Planning, a comprehensive software platform that guides users through every step of the exit planning process. It offers a range of features, including financial analysis tools, valuation calculators, and interactive checklists, to help business owners assess their current situation and make informed decisions.

Overall, having the right software can make all the difference in effectively planning for your business exit. Exit planning software provides valuable resources and tools to simplify the process and ensure a successful transition. Consider exploring these software options to find if they best fits your business needs and helps you create a comprehensive and strategic exit plan.