Maus Software Named Exit Factor’s Partner Of The Year At 2025 Exit Factor Conference

Maus Software, the leading provider of exit planning software, has been named Partner of the Year by Exit Factor at their second annual Exit Factor...

Affordable software solution for independent financial advisors: how to build a lean tech stack, cut costs, and use Maus to deliver deeper planning value.

Independent financial advisors are under pressure to do more with less, more planning, more reporting, more client communication, without adding runaway software costs.

The right affordable software solution for independent financial advisors isn’t just “the cheapest tool”; it’s the stack that gives you planning depth, practice efficiency, and room to scale without breaking your budget.

This guide breaks down what “affordable” should really mean, how to evaluate tools, and where an all-in-one platform like Maus can replace spreadsheets and disconnected point solutions.

1-minute recap: what “affordable” advisor software really looks like

If you only take one thing away from this article, make it this:

We’ll unpack how to evaluate your options, and where Maus fits, in the sections below.

The advisor tech landscape has exploded: planning software, CRM, TAMPs, billing, client portals, risk tools, risk tolerance, analytics, AI assistants… and almost all of them are subscription-based.

One recent practice-management article found that “over half of financial advisors are considering leaving their current firm for one with better tech tools”, underscoring how central software has become to both advisor satisfaction and client experience.

For independent advisors, that presents a double challenge:

That’s why “affordable” software should be judged on three dimensions:

Google’s AI Overview highlights common categories, planning tools like RightCapital, CRMs like Wealthbox, Excel/Google Sheets for custom work, accounting tools like QuickBooks, and all-in-one platforms like Orion or eMoney.

That’s directionally correct, but independent advisors don’t need every category on day one.

%20-%20visual%20selection.png?width=972&height=636&name=What%20independent%20advisors%20actually%20need%20from%20software%20(not%20just%20vendor%20logos)%20-%20visual%20selection.png)

Think in functions, not brands:

You need to:

Good financial analysis software consolidates data from accounting systems, spreadsheets, and other sources into clear, actionable reports, so every recommendation is backed by accurate insights.

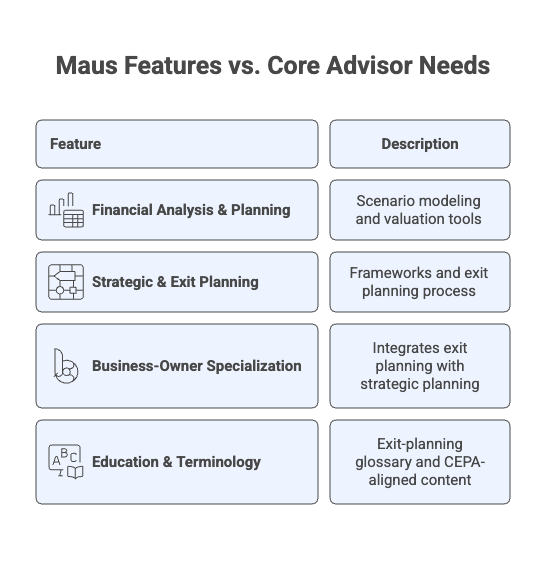

Maus supports this through built-in financial analysis, scenario modeling, and business valuation tools designed for advisors and consultants.

A lightweight CRM (or good CRM discipline) helps you:

Whether you use a purpose-built advisor CRM or a general CRM, connect it to your planning & analysis tools so you’re not re-entering data.

You need secure, compliant storage for:

Cloud storage or document-management tools are fine, but tying them into a platform that auto-generates reports and presentations is far more efficient.

Even if you rely on QuickBooks or a similar tool today, you’ll eventually want:

This is the category AI Overviews often miss—but it’s where independent advisors can differentiate the most.

Exit planning is regarded as “the next major value horizon for financial advisors, much like estate planning was previously”.

If you work with business-owner clients, exit and succession planning is where you can:

This is exactly where Maus is positioned. Learn more about Maus.

Instead of bolting together separate tools for:

…Maus provides an all-in-one platform that covers these workflows in a single subscription.

For independent financial advisors, that delivers affordability in three ways:

Maus’s pricing is built around unlimited clients and how you use the software (Attract, Engage, or Build), not per-client fees that punish growth.

Instead of maintaining separate licenses for planning, valuation spreadsheets, exit-planning templates, and reporting, you consolidate those functions into Maus.

Advisors using Maus report meaningful efficiency gains. In one case study, Virginia Asset Management grew revenue by 400% after integrating Maus into its exit-planning offering—showing how the right platform can unlock both time savings and new fee revenue.

Here’s how Maus lines up against the core needs we outlined earlier:

Because Maus sits beside your custodian, CRM, and accounting system, it becomes the bridge between personal wealth planning and business-owner value planning.

If you want to go beyond “which software should I buy?” and into how to use it strategically, there are several Maus articles worth weaving into your learning path:

Linking these resources from your own content or client education materials reinforces your positioning as a tech-enabled, process-driven advisor.

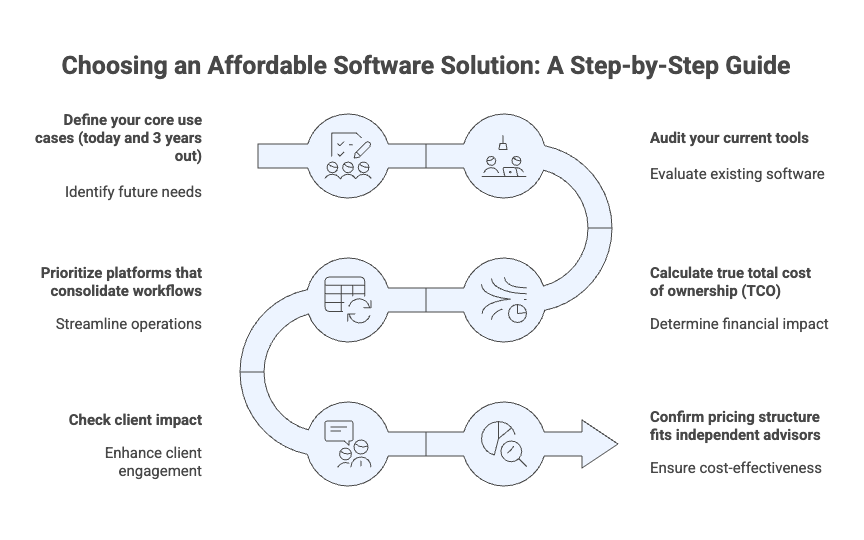

Use this checklist before you sign any new software contract:

Serving mass-affluent households only? Or also business owners?

Do you want to add exit/succession planning, value-driver analysis, or CEPA-style engagements?

Where are you already paying twice for similar features (planning, analytics, reporting)?

Which workflows still live in Excel/Sheets because existing tools can’t handle them?

License fees (per-user, per-account, or per-AUM)

Implementation and data-migration time

Staff hours on report building, templates, and manual processes

Can the tool handle strategic planning, business analysis, exit planning, and reporting together (like Maus)?

Does it integrate with accounting tools like QuickBooks or Xero so you aren’t re-keying data?

Will this software help you explain complex topics—like exit readiness, value drivers, or retirement projections—in a visual, client-friendly way?

Can you easily generate deliverables that justify your fees?

Avoid models that penalize growth with steep per-client fees.

Look for unlimited-client pricing or tiers that scale predictably (as Maus does for financial advisors).

If you can check these boxes, you’re looking at a genuinely affordable solution—not just a low sticker price.

Affordability shouldn’t be confused with under-investing in technology.

A 2025 article on must-have financial advisor tools notes that embracing the right tools is now the difference between “honing your competitive edge and falling behind”, and highlights that more than half of advisors would switch firms for better tech.

For independent advisors, that same logic applies at the practice level: if your software is slow, fragmented, or visually underwhelming, clients will notice—and so will your staff.

The key is to invest in the fewest, most powerful platforms that support your strategy. For a wide range of advisors serving business owners, that means adding Maus as the strategic planning and exit-planning hub of your stack.

If you’re brand-new and cash-constrained, it’s reasonable to combine spreadsheets with a basic CRM and low-cost billing tool. But as soon as you start serving business-owner clients or offering deeper planning, you’ll outgrow that setup. At that point, a platform like Maus for Financial Advisors, which consolidates financial analysis, strategic planning, and exit planning in one place with unlimited clients, often becomes more affordable than juggling multiple point solutions.

Traditional planning tools often price around per-advisor or per-client licenses and may focus primarily on household retirement planning. Maus is designed for advisors who want to add business advisory and exit planning, with transparent pricing tiers and unlimited clients so you can scale revenue without steep incremental software costs.

Yes. Maus includes built-in financial analysis, business valuation, and exit-planning frameworks so you can move beyond ad-hoc spreadsheets into a consistent, auditable process. This reduces errors, speeds up modeling, and produces more professional client deliverables.

No. Maus was intentionally designed so firms and practices of all sizes—including solo and small independent advisors—can deliver institutional-grade exit planning and strategic advisory work. Pricing is structured to support smaller practices and grow with you as you add clients and service lines.

By adding exit and succession planning, value-driver analysis, and strategic planning services, you move from portfolio manager to primary advisor on the client’s biggest asset: their business. Maus gives you the tools, templates, and education (including CEPA-aligned resources and an exit-planning glossary) to deliver that value efficiently—so the same hours you spend with clients generate higher fees and stickier relationships.

Maus Software, the leading provider of exit planning software, has been named Partner of the Year by Exit Factor at their second annual Exit Factor...

What is exit planning? It's a question that many business owners may ask themselves when they are using an Exit Planning Process...

What is exit planning? It's a question that many business owners may ask themselves when they start thinking about the future of their company....

Be the first to know about new tools and knowledge from the fast-paced world of exit planning.