Common EBITDA Adjustments and What They Mean for Your Business

Learn about common EBITDA adjustments and how they impact business valuation, financial reporting, and core profitability.

Various methods can be used to measure the value of a business. One popular approach is valuation using multiples valuation

Various methods can be used to measure the value of a business. One popular approach is valuation using multiples valuation, also known as the multiples approach. This method involves comparing a company’s financial metrics to those of similar businesses that have recently been sold.

By looking at these multiples, entrepreneurs can better understand their business’s value.

In this blog post, we will dive into the definition of valuation using multiples valuation, explore its significance in small business valuation, and provide examples of how this method can be applied effectively.

The multiples approach, also known as the market-based approach, is a valuation method that determines a company’s value by comparing its financial metrics to those of similar businesses that have recently been sold or are publicly traded.

This approach operates on the principle that similar companies (or assets) should be valued similarly. By applying financial ratios (or ‘multiples’) observed from peer companies to the company being valued, an estimate of the company’s value is derived.

This methodology hinges on the utilization of multiples – ratios that connect a company’s financial performance metrics, such as earnings, value range, revenue, or assets, to its market value or price. Common examples of these ratios include the price-to-earnings (P/E) ratio, price-to-sales (P/S) ratio, and price-to-book (P/B) ratio.

This method simplifies business valuation by benchmarking a company against its peers rather than valuing it in isolation. It assumes that similar companies provide a relevant yardstick for valuation due to shared market, economic, and operational characteristics.

To implement the multiples approach, an entrepreneur or analyst identifies comparable companies or “comps,” assesses their trading multiples, and then applies them to the target company’s financial metrics. This process generates a range of values that offer insights into what the market might be willing to pay for the business.

The choice of multiples is critical and varies by industry, reflecting how different sectors prioritize different value drivers. For instance, technology companies might be more commonly evaluated based on P/S ratios due to their growth focus.

In contrast, manufacturing firms might be assessed on P/E ratios due to their earnings-driven value proposition. Identifying the most relevant multiple requires a deep understanding of the industry and the factors most significantly influence company valuations.

This method’s elegance lies in its simplicity and the direct market comparison it facilitates, providing entrepreneurs with a practical tool for estimating their company’s market value.

The essence of valuation using multiples revolves around comparing financial metrics between businesses within the same sector or industry. It’s a method that simplifies the complex landscape of business valuation by anchoring a company’s worth to that of its counterparts, thereby providing a more straightforward, more accessible path to understanding market value.

This approach is particularly advantageous for small businesses, offering a direct avenue to gauge their position in the competitive landscape without diving into intricate financial models.

At its core, the multiples valuation method uses ratios—price-to-earnings (P/E), price-to-sales (P/S), and price-to-book (P/B), among others—that connect various financial performance indicators with the company’s market value or stock price.

Each of these ratios serves as a multiple, acting as a mirror to reflect the business’s value as seen through the lens of market trends and peer performance.

Identifying the appropriate multiple is a critical step in this process. It requires a nuanced understanding of the industry, knowledge of which financial metrics are most relevant to business valuation in that context, and an awareness of the economic forces at play.

For instance, a high-growth tech startup might be evaluated differently, using the P/S ratio, than a stable manufacturing firm, which may lean on the P/E ratio. This differentiation underscores the importance of selecting multiples that align with industry norms and accurately reflect the company’s operational realities and growth prospects.

By drawing on comparative analysis, multiples valuation offers a streamlined, effective way for entrepreneurs to ascertain their business’s market value. It encourages a broader view, considering how external perceptions and comparable company performances can illuminate one’s business valuation.

The significance of multiples cannot be overstated. These financial ratios serve as a lens through which entrepreneurs can view their business compared to others within the same industry.

This perspective is invaluable, offering clarity on a business’s market standing and helping to highlight potential areas for improvement or growth. Multiplying multiples enables small business owners to benchmark their performance against established standards, facilitating informed decision-making processes.

For a small business, the application of multiples extends beyond mere valuation; it becomes a strategic tool for navigating market dynamics.

By understanding how their business is valued by peers, entrepreneurs can identify competitive advantages or uncover areas requiring strategic adjustments. This insight is particularly beneficial when considering expansions, mergers, or acquisitions, as it provides a solid foundation for negotiations and investment discussions.

Moreover, multiples offer a framework for goal setting and performance evaluation. By regularly assessing their business’s value through multiples, small business owners can set realistic financial targets and monitor progress toward achieving these goals.

This ongoing evaluation helps ensure that strategic actions effectively enhance business value and position the company more favorably in the market.

In essence, multiples in small business valuation embody a crucial strategic planning and operational analysis component. They empower entrepreneurs with actionable insights, enabling a proactive business development and financial management approach.

This proactive stance is vital for sustaining growth and securing a competitive edge in the dynamic business environment.

Selecting the appropriate multiples for your company is crucial in accurately valuing your business and making informed strategic decisions.

Each industry has its set of commonly used multiples, reflecting the unique factors driving that sector’s value.

For instance, tech startups often rely on revenue-based multiples like the price-to-sales (P/S) ratio due to their growth potential, while more established, income-generating companies might focus on earnings-based multiples such as the price-to-earnings (P/E) ratio.

Conduct thorough research on your industry to identify which multiples are most relevant for your business. Look into similar companies’ transactions to understand which multiples were used and why.

This investigation will offer insights into the financial metrics that investors prioritize when evaluating companies within your sector.

Additionally, consider the stage of your business and its economic health. For startups and high-growth companies, revenue or user growth might be more indicative of value, whereas for mature companies, profitability metrics might take precedence.

Engaging with industry reports and consulting with financial analysts can also provide valuable perspectives on the appropriate multiples.

Remember, the goal is to choose multiples that align with industry norms and accurately reflect your company’s operational realities and growth prospects.

Selecting the right multiples ensures a more accurate and meaningful valuation that resonates with potential investors and aligns with your strategic goals.

First, identify the most relevant financial metric that aligns with the chosen multiple to initiate the process of calculating a company’s valuation using multiples.

This could be earnings, revenue, book value, or another pertinent metric, depending on the nature of your industry and its standard valuation practices. After pinpointing this metric, the next step involves researching comparable companies, often called “comps,” that operate within your sector and have publicly available financials.

With this comparison group established, analyze their multiples to understand the average or median values currently being applied in the market.

This requires gathering data on their market value—which could be the market capitalization for publicly traded companies or the final sale price for private transactions—and dividing it by the relevant financial metric, such as net income for P/E ratios or revenue for P/S ratios.

After compiling this benchmark data, apply the derived multiple to your company’s financial metric. For instance, if the average P/E ratio for your comps is 20 and your business’s annual earnings are $500,000, your business would be valued at approximately $10,000,000 using this multiple.

It’s essential to remember that multiples can fluctuate widely across different industries and even within segments of the same industry.

Therefore, ensuring that the comps chosen are truly comparable in size, growth rate, and market conditions is crucial for an accurate valuation. Additionally, consider leveraging a range of multiples to capture a broader perspective of your business’s value, recognizing that no single number can encapsulate all dimensions of its worth.

Thus, your company’s estimated valuation would be $10,000,000 using a P/E ratio of 20.

Let’s explore real-world small business valuation multiples to demonstrate how the multiples valuation method is applied effectively across different scenarios:

Scenario: A thriving e-commerce startup preparing for fundraising.

Relevant Multiple: Price-to-Sales (P/S) ratio.

Industry Benchmark: P/S ratio of 5.

Financial Metric: Last year’s sales of $2 million.

Valuation Calculation:

Outcome: The startup’s market valuation is $10 million, providing a discussion benchmark for negotiations with investors.

Scenario: A family-owned restaurant chain considering a sale.

Relevant Multiple: Price-to-Earnings (P/E) ratio.

Industry Benchmark: P/E ratio of 10.

Financial Metric: Annual earnings of $300,000.

Valuation Calculation:

Outcome: The restaurant chain’s valuation is $3 million, aiding in pricing the business and engaging with potential buyers.

Scenario: A construction company evaluating its market value.

Relevant Multiple: Price-to-Book (P/B) ratio.

Industry Benchmark: P/B ratio of 1.5.

Financial Metric: Book value of $4 million.

Valuation Calculation:

Outcome: The construction company’s market valuation is $6 million.

Scenario: A business advisory firm determining its valuation for potential sale.

Relevant Multiple: Price-to-Earnings (P/E) ratio.

Industry Benchmark: P/E ratio of 12.

Financial Metric: Annual earnings of $250,000.

Valuation Calculation:

Outcome: The business advisory firm’s valuation is $3 million.

Scenario: A struggling retail business looking to understand its market value for a potential turnaround strategy.Relevant Multiple: Price-to-Sales (P/S) ratio.Industry Benchmark: P/S ratio of 0.5 (lower than thriving businesses due to struggles).Financial Metric: Last year’s sales of $1 million.Valuation Calculation:

Outcome: The struggling retail business’s market valuation is $500,000, reflecting its current challenges.

Scenario: A large car dealership chain evaluating its market value.

Relevant Multiple: Enterprise Value to EBITDA (EV/EBITDA) ratio.

Industry Benchmark: EV/EBITDA ratio of 8.

Financial Metric: Annual EBITDA of $50 million.

Valuation Calculation:

Outcome: The car dealership chain’s market valuation is $400 million.

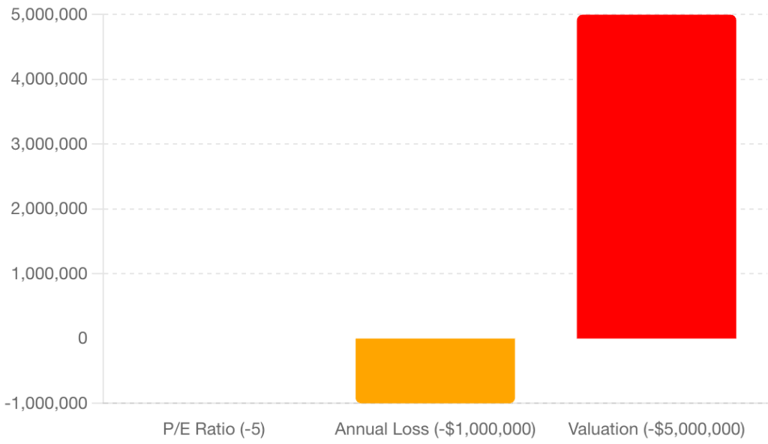

Scenario: An unprofitable retail business trying to understand its market value for restructuring.

Relevant Multiple: Price-to-Earnings (P/E) ratio (negative due to losses).

Industry Benchmark: P/E ratio of -5 (negative due to unprofitability).

Financial Metric: Annual loss of $1 million.

Valuation Calculation:

Outcome: The retail business’s market valuation is -$5 million, indicating a severe undervaluation due to its unprofitable status.

Integrating valuation goals into your business plan is a strategic move that can significantly impact the trajectory of your business.

Understanding your company’s market value through the lens of multiples valuation equips you with the insights to steer your business toward financial milestones that are not only ambitious but also realistic.

This process involves setting clear objectives that resonate with the valuation metrics identified as pivotal within your industry.

For example, if revenue growth emerges as a critical valuation driver in your sector, your business plan should prioritize strategies that amplify sales and market reach.

Additionally, this alignment facilitates targeted investment in areas with the most substantial impact on your company’s valuation.

Knowing where your business stands compared to industry benchmarks allows for informed decision-making, whether it’s product development, market expansion, or operational efficiency.

It also provides a framework for evaluating potential investments or operational shifts in the context of their anticipated effect on your business’s valuation.

Crafting a business plan with an eye on valuation goals encourages a forward-looking approach to business development. It compels you to consider immediate operational needs and long-term strategic initiatives that enhance your company’s market position and financial health.

By focusing on valuation goals, you ensure that every aspect of your business plan contributes to building a more valuable, robust, and competitive enterprise.

Multiples valuation requires precision and awareness of potential pitfalls that can significantly skew the results.

One of the primary errors is the selection of inappropriate multiples, which may not accurately reflect the industry norms or the business’s specific circumstances.

This misstep can lead to valuation figures that are either overly optimistic or unduly conservative, thereby distorting a company’s true market value.

Another frequent oversight is the inadequate adjustment for market conditions. Economic climates and sector-specific trends heavily influence valuation multiples, and failing to account for these factors can result in a valuation that does not truly represent current market realities.

For instance, a booming market might inflate multiples, while an economic downturn could depress them. Entrepreneurs need to adjust their valuation expectations accordingly to remain relevant and realistic.

Moreover, over-reliance on multiples valuation without considering the broader context of the business can lead to inaccuracies.

Multiples provide a snapshot based on quantifiable data but may not fully capture qualitative aspects such as management quality, brand reputation, or market potential.

These elements, though harder to quantify, can substantially impact a company’s value.

Thus, while multiples are a helpful tool, they should be part of a more extensive toolkit that assesses a company’s worth from multiple angles to avoid a narrow or skewed valuation perspective.

Employing valuation via multiples is not merely a mechanism for determining a business’s market value; it stands as an insightful gauge for tracking progress and achieving milestones.

Through periodic evaluation, small business owners can discern the effectiveness of their strategies and operational tweaks in real time. This ongoing assessment enables a deeper understanding of how strategic decisions impact the business’s valuation compared to industry peers.

By observing these valuation shifts, entrepreneurs gain the capability to identify strengths to build upon and areas necessitating improvement.

It’s a continuous feedback loop, offering concrete data that reflects the business’s trajectory within the competitive landscape.

Such insights are invaluable, providing a clear picture of where the company stands and what it takes to elevate its market position. As valuation figures evolve, they narrate the story of a business’s journey—highlighting successes, pinpointing challenges, and informing future strategic directions.

Leveraging valuation as a measure of success equips entrepreneurs with a robust framework to guide their businesses towards sustainable growth and enhanced competitiveness. This methodology transcends mere numbers, embodying a dynamic approach to understanding and nurturing business potential.

In summary, the approach of valuation using multiples offers a pragmatic framework for entrepreneurs to gauge the worth of their ventures.

This methodology, grounded in comparative financial analysis, empowers business owners to make informed decisions grounded in the market realities of their industries.

By leveraging financial ratios and benchmarking against comparable businesses, entrepreneurs gain critical insights into their company’s positioning and potential market value.

Such knowledge is indispensable for strategic planning, including growth initiatives, financial management, and when contemplating mergers or exits. Embracing this valuation method allows for a clearer vision of how a business is perceived in the broader market and underscores the importance of strategic alignment with financial objectives.

Entrepreneurs who adeptly navigate the nuances of multiples valuation can better steer their businesses towards enhanced market competitiveness and value creation, ultimately achieving their financial and operational goals with greater precision and confidence.

Learn about common EBITDA adjustments and how they impact business valuation, financial reporting, and core profitability.

This article defines value drivers in business, their role in value-driven enterprise risk management, and how companies can identify...

Understand Enterprise Value vs Equity Value, how debt & cash shift each, and what CEPA advisors must know to maximize owner exit outcomes.

Be the first to know about new tools and knowledge from the fast-paced world of exit planning.